In the world of finance, market sentiment indicators play a crucial role in gauging the overall mood and attitude of investors towards a particular market or asset class. By analyzing these indicators, traders and investors can gain valuable insights into market trends and potential price movements. Recently, three key market sentiment indicators have confirmed a bearish phase in the financial markets, providing important signals for market participants.

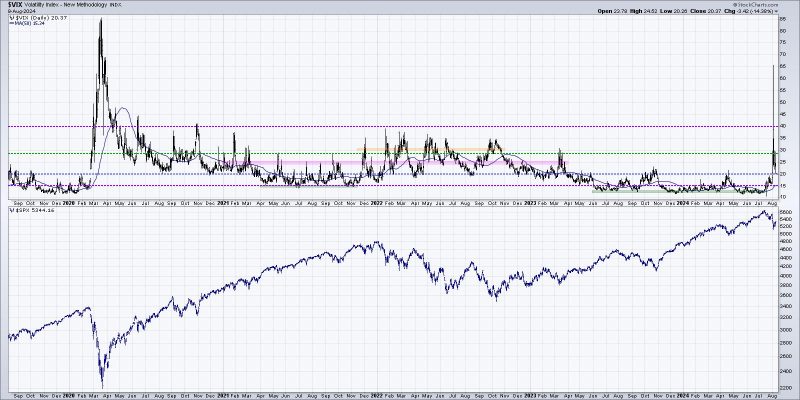

The first market sentiment indicator signaling a bearish phase is the CBOE Volatility Index (VIX), often referred to as the fear gauge. The VIX measures market expectations of near-term volatility conveyed by S&P 500 stock index option prices. A rising VIX indicates increasing market uncertainty and investor fear, typically coinciding with declining stock prices. In recent times, the VIX has seen a notable uptick, reflecting heightened concerns and a shift towards a more risk-averse market sentiment.

Another significant market sentiment indicator pointing towards a bearish phase is the Investors Intelligence Bull/Bear ratio. This ratio measures the sentiment of investment newsletter writers and analysts, providing insights into the prevailing sentiment among market professionals. A high Bull/Bear ratio suggests market optimism and potentially excessive bullishness, which can precede market corrections or downturns. Conversely, a lower ratio indicates growing bearish sentiment among professionals, signaling a shift towards a more pessimistic market outlook. The recent data from Investors Intelligence has shown a decrease in the Bull/Bear ratio, aligning with the emergence of a bearish phase in the markets.

The third market sentiment indicator reinforcing the bearish outlook is the put/call ratio, a measure of options trading activity that compares the number of put options (bearish bets) to call options (bullish bets) traded on a given security or index. A high put/call ratio indicates a higher level of bearish sentiment among options traders, suggesting a potential downturn in the market. Conversely, a low put/call ratio reflects a more bullish sentiment and a possible uptrend. The current data on the put/call ratio has shown an increase in bearish positioning, supporting the narrative of a bearish phase in the markets.

In conclusion, market sentiment indicators play a critical role in assessing the prevailing mood and sentiment among investors and traders. The recent confirmation of a bearish phase by key indicators such as the VIX, Investors Intelligence Bull/Bear ratio, and put/call ratio highlights the growing pessimism and risk-aversion in the financial markets. By paying close attention to these indicators and understanding their implications, market participants can make informed decisions and navigate effectively in volatile market conditions.