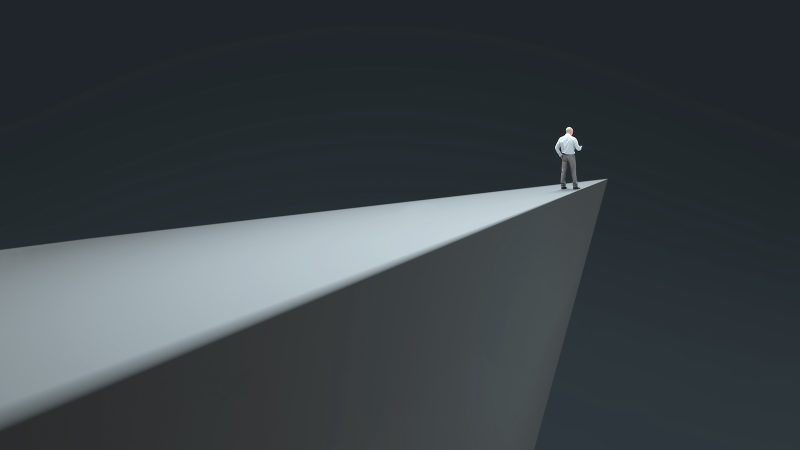

In recent weeks, the Nasdaq has been caught in a downward spiral, with investors and analysts closely monitoring critical levels that may offer insight into the index’s future trajectory. As the tech-heavy index teeters on the edge, it is essential to pay attention to key support and resistance levels that could potentially dictate market movements.

One of the critical levels to watch on the Nasdaq is the 50-day moving average. The 50-day moving average is a widely-used technical indicator that represents the average closing price of the index over the past 50 trading days. As a moving average, it smoothens out fluctuations in the index’s price and helps identify trends. If the Nasdaq falls below its 50-day moving average, it could signal further downside and potentially trigger a more prolonged bearish trend.

On the upside, traders will be closely monitoring the 200-day moving average for the Nasdaq. The 200-day moving average is considered a significant support level that indicates the long-term trend of the index. If the Nasdaq breaches its 200-day moving average to the downside, it could spark panic selling and add further pressure to an already fragile market sentiment.

Another critical level to watch on the Nasdaq is the support and resistance zones. Support levels are price levels where a stock or index finds it challenging to fall below, while resistance levels are price levels where it struggles to rise above. By identifying these levels, traders can anticipate potential price movements and adjust their trading strategies accordingly.

In addition to technical indicators, investors should also pay attention to broader market factors that could impact the Nasdaq’s performance. Geopolitical events, economic data releases, and changes in interest rates can all influence market sentiment and drive price action. By staying informed and proactive, investors can better navigate volatile market conditions and make well-informed investment decisions.

As the Nasdaq hovers at critical levels, it is essential for investors to remain vigilant and adaptable in their approach. By closely monitoring key technical indicators, support and resistance levels, and external market catalysts, investors can position themselves to weather market volatility and capitalize on potential opportunities that arise. Ultimately, a disciplined and informed investment strategy will be crucial in navigating the uncertain terrain ahead.