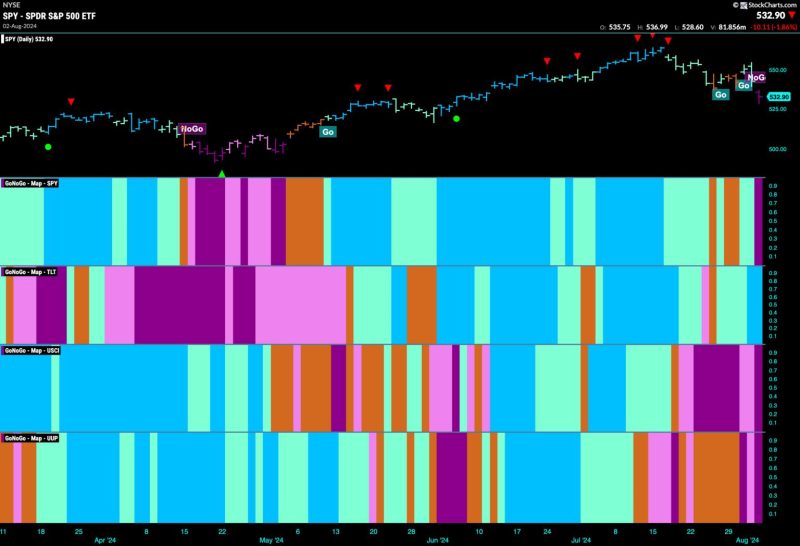

Stocks Get Defensive as Market Index Enters No-Go Zone

The stock market has been a rollercoaster of volatility in recent months, with investors navigating through economic uncertainties and global tensions. As the market index enters what analysts are calling the No-Go Zone, many investors are reevaluating their strategies and turning to defensive stocks to weather the storm.

What exactly are defensive stocks, and why are they becoming more appealing in the current market environment? Defensive stocks are typically companies that provide essential products or services, such as utilities, healthcare, and consumer staples. These companies tend to have stable earnings and strong balance sheets, making them less vulnerable to economic downturns.

One reason investors are flocking to defensive stocks is their ability to provide a reliable stream of income even in times of market turbulence. With concerns of a looming recession and trade tensions between major economies, many are seeking refuge in companies that are less exposed to economic cycles.

Additionally, defensive stocks are known for their resilience during market downturns. While growth stocks may experience significant volatility, defensive stocks often outperform the market, offering a sense of stability and capital preservation for investors.

Another factor driving the demand for defensive stocks is their relatively attractive dividends. Many defensive companies have a long history of paying dividends consistently, making them an appealing choice for income-oriented investors looking for reliable cash flows.

However, it’s important for investors to conduct thorough research before diving into defensive stocks. Not all companies in defensive sectors are created equal, and factors such as valuation, financial health, and growth prospects should be taken into consideration.

In conclusion, as the market index enters a challenging phase, defensive stocks have emerged as a safe haven for investors seeking stability and income in uncertain times. By incorporating defensive stocks into their portfolios, investors can potentially mitigate risks and navigate through market volatility with more confidence.