The Federal Reserve (the Fed) is a key player in the United States’ economic landscape, tasked with the responsibility of fostering stable prices and maximum employment. However, recent decisions made by the Fed have led to unintended consequences that threaten the very stability it aims to uphold.

One of the primary tools in the Fed’s arsenal is monetary policy, particularly through the setting of interest rates. Lowering interest rates can stimulate borrowing and spending, thus spurring economic growth. In response to the economic uncertainty caused by the COVID-19 pandemic, the Fed slashed interest rates to near-zero levels in an attempt to bolster the economy.

While this move was initially lauded as a necessary step to prevent a complete economic collapse, it has since created a series of ripple effects that are now coming back to haunt both the Fed and the general populace. By keeping interest rates artificially low for an extended period, the Fed inadvertently incentivized excessive risk-taking and speculative behavior in financial markets.

Investors, hungry for higher returns in a low-yield environment, sought out riskier assets in pursuit of greater profits. This led to asset bubbles forming in various sectors, including tech stocks and cryptocurrencies, as prices skyrocketed beyond their intrinsic values. The reliance on leverage and debt to fuel these investments further exacerbated the fragility of the market.

As these bubbles continue to expand, the risk of a sudden and catastrophic burst looms large. Should these overvalued assets come crashing down, the repercussions would be felt not only by investors but by the broader economy as well. The wealth destruction and subsequent economic downturn could undo any progress made in the post-pandemic recovery, plunging the nation into a deep recession.

Moreover, the Fed now finds itself in a challenging position, caught between a rock and a hard place. Raising interest rates to curb excessive speculation and deflate asset bubbles could trigger a market selloff and worsen the economic outlook. On the other hand, maintaining the status quo risks a further escalation of risky behavior and the eventual implosion of these bubbles.

In essence, the Fed has unwittingly painted itself into a corner, with limited options for extricating itself from the mess it helped create. The delicate balancing act of managing monetary policy to support economic growth while averting financial instability has become increasingly precarious in the face of mounting pressure and systemic risks.

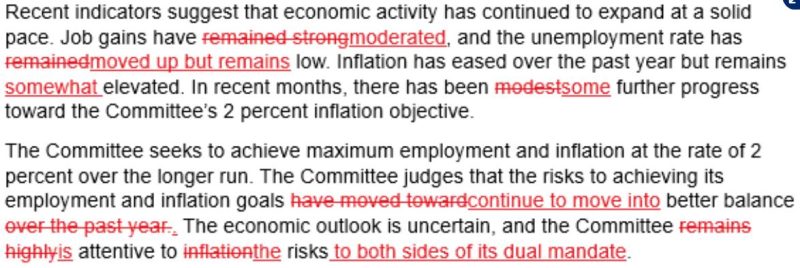

As we navigate these turbulent times, it is imperative for the Fed to reassess its strategies and recalibrate its approach to mitigate the looming threats on the horizon. Transparency, clear communication, and a proactive stance in addressing potential vulnerabilities are crucial in restoring confidence and stability in the financial system.

In conclusion, the Fed’s well-intentioned efforts to navigate the economic fallout of the pandemic have inadvertently sown the seeds of a financial disaster. Only through prudent and decisive action can the Fed hope to avert the nightmare scenario it has helped create and chart a path towards a more sustainable and resilient future.