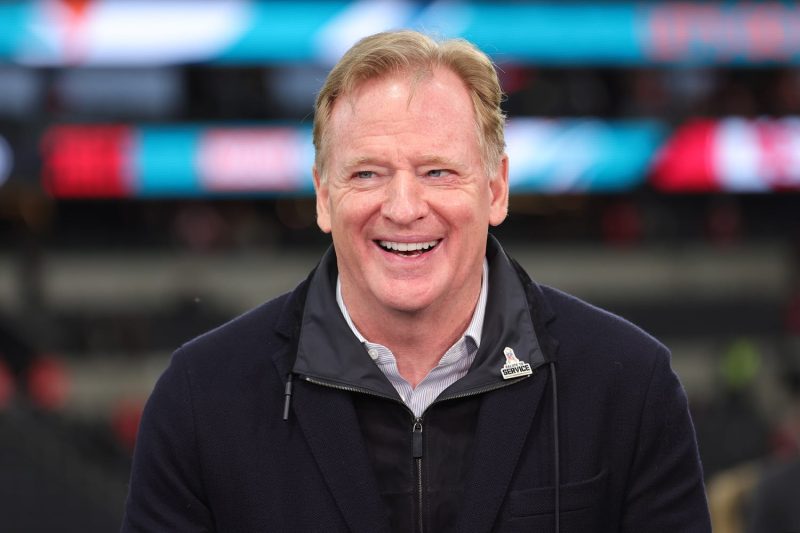

The recent potential shift towards private equity team ownership in the NFL has stirred up a myriad of reactions and discussions among fans, teams, and industry experts alike. Roger Goodell, the Commissioner of the NFL, revealed that the league is now open to allowing up to 10% of team ownership by private equity firms. This proposed change marks a significant departure from the traditional model of ownership in the league, where teams are predominantly owned by individuals or families.

While the prospect of private equity firms owning stakes in NFL teams may raise concerns about the commercialization of the sport and potential conflicts of interest, there are several reasons why this shift could benefit the league and its stakeholders.

First and foremost, introducing private equity ownership could inject significant capital into NFL teams, allowing them to expand their operations, invest in infrastructure, and enhance the overall quality of the league. Private equity firms are known for their ability to provide substantial financial resources and strategic guidance to their portfolio companies, which could help NFL teams navigate challenges and capitalize on opportunities in an increasingly competitive sports landscape.

Moreover, private equity ownership could bring a fresh perspective and innovative ideas to the management and governance of NFL teams. By working closely with experienced investors, team owners could gain access to valuable expertise in areas such as branding, marketing, and fan engagement, helping them to drive growth and sustainability in the long term.

Additionally, allowing private equity firms to own stakes in NFL teams could open up new avenues for partnerships and collaborations within the sports industry. With private equity investors on board, teams could potentially forge strategic alliances with other companies, leagues, or organizations, leading to increased revenue streams, expanded fan bases, and enhanced global exposure for the NFL.

Of course, there are challenges and potential drawbacks associated with private equity ownership in the NFL that must be carefully considered. Critics argue that private equity firms may prioritize short-term profits over the long-term interests of the league and its fans, leading to decisions that could compromise the integrity and values of the sport. Furthermore, concerns have been raised about the potential for conflicts of interest, insider dealings, and lack of transparency that could arise from private equity involvement in team ownership.

Ultimately, the idea of private equity team ownership in the NFL represents a significant departure from the status quo and raises important questions about the future direction of the league. While there are potential risks and challenges associated with this proposed shift, there are also compelling reasons to believe that private equity ownership could bring valuable benefits and opportunities to NFL teams, fans, and the broader sports industry.

As the NFL continues to explore this new frontier of ownership, it will be crucial for league officials, team owners, players, and fans to engage in open and constructive dialogue to ensure that any potential changes are made in the best interests of the game and its stakeholders. Only time will tell how private equity ownership will shape the future of the NFL, but one thing is certain: the landscape of professional sports ownership is evolving, and the NFL is at the forefront of this transformation.